Understanding the Scheme(National Rural Livelihood Mission)

Overview of the National Rural Livelihood Mission

Despite the remarkable growth in India’s Gross Domestic Product (GDP), a substantial rural population still resides below the poverty line (BPL). Various studies have indicated varying levels of rural poverty, presenting an enduring challenge to all levels of the Government.

Initiating Change

To combat this persistent issue of rural poverty, the Ministry of Rural Development introduced a mission-oriented scheme known as the National Rural Livelihood Mission (NRLM) in 2010. Later, on March 29, 2016, it was rebranded as DAY-NRLM (Deendayal Antyodaya Yojana – National Rural Livelihood Mission). This centrally sponsored scheme involves joint funding from both the Central and State Governments for its projects.

Implementation Structure

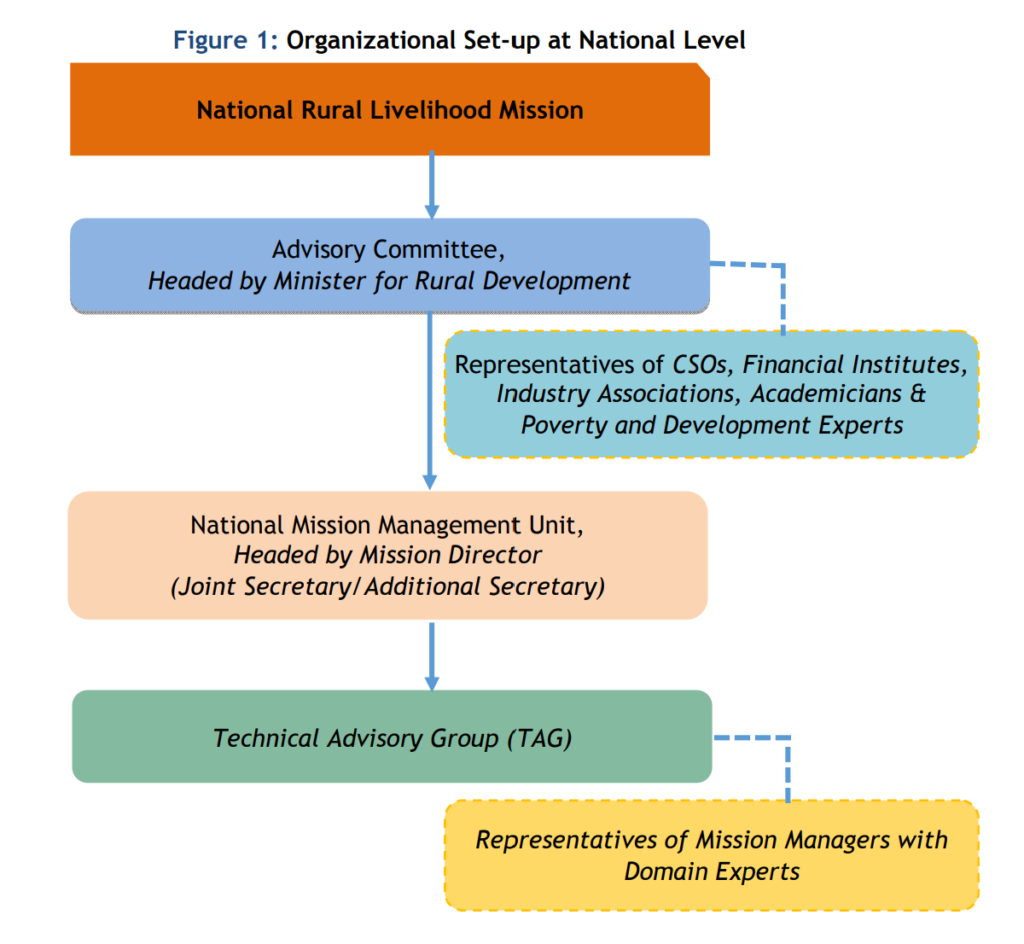

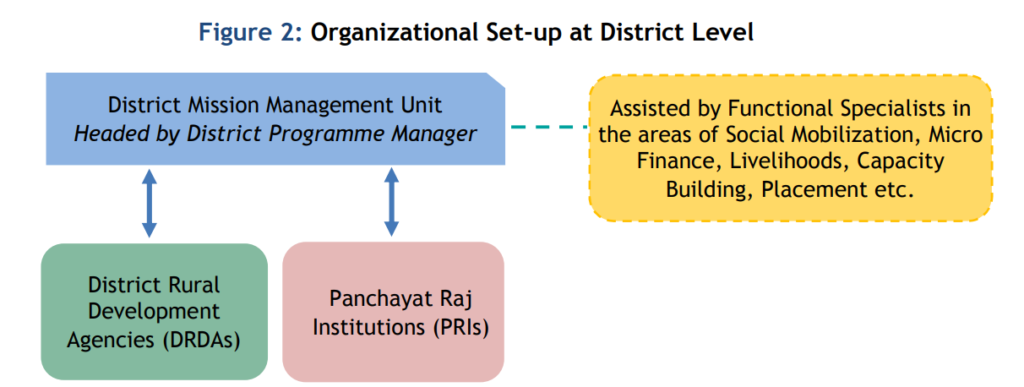

The State Rural Livelihood Missions (Special Purpose Vehicles) hold the responsibility for executing the Mission, with the District Mission Management Unit (DMMU) at the district level overseeing planning and implementation under the district administration’s control. At the block level, the Block Mission Management Unit handles the Mission’s activities.

Phased Approach

Implemented in a phased but intensive manner, the Mission selects a specific number of blocks each year. With an ambitious goal, the Mission aims to mobilize all rural poor households comprehensively by the year 2023-24.

Government Oversight

The Department of Rural Development in the Ministry of Rural Development, Government of India (GoI), takes charge of policy formulation, monitoring, evaluation of the program, and fund allocation. This collaborative effort between the central and state entities underscores a dedicated commitment to uplift the rural poor and create sustainable livelihoods.

Official Document by Central Government

Scheme Objective: Empowering Livelihoods

Mission Goal

The primary objective of the Mission is to uplift the poor by promoting sustainable livelihoods, enabling them to break free from the clutches of poverty. The focus is on empowering the economically vulnerable by providing access to formal credit, supporting livelihood diversification and strengthening, and facilitating access to entitlements and public services.

Unveiling Key Features

Inclusivity through SHGs

- Self Help Groups (SHGs): Each rural poor household, with a preference for women, becomes a member of the SHG network. Women-led SHGs establish bank-linkage arrangements.

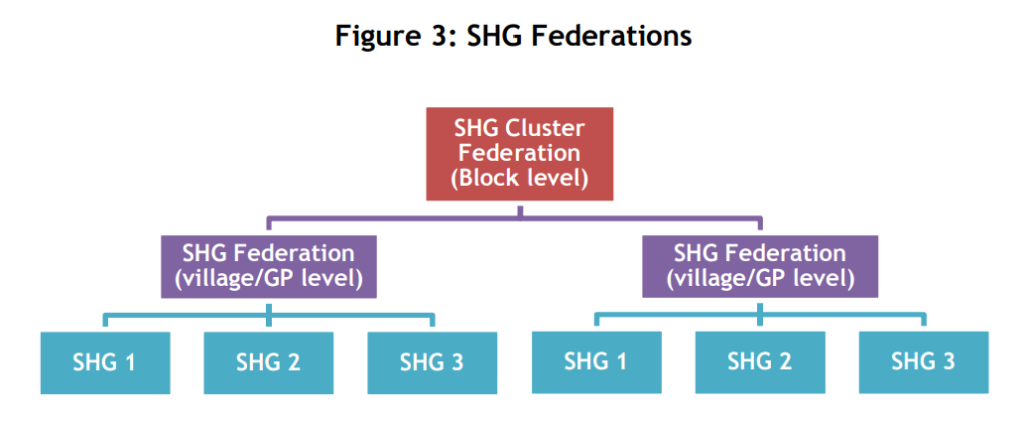

- Federated Structure: SHGs are federated at village and higher levels to offer a platform for space, voice, and resource sharing, reducing dependence on external agencies.

Mission Components

The Mission comprises four key components:

- Social Mobilization and Capacity Building: Focuses on building community institutions and enhancing capacity.

- Financial Inclusion: Aims to integrate the poor into the formal financial system.

- Livelihood Promotion: Strives to enhance and diversify livelihood opportunities.

- Convergence: A coordinated effort involving multiple components for comprehensive impact.

Targeted Social Assessment

- Participatory Social Assessment: Organizes assessments to identify and rank households based on vulnerability, with special attention to the poorest, single women, woman-headed households, disabled individuals, landless families, and migrant labor.

Capacity Building

- Training Initiatives: Empowers the poor in managing institutions, livelihoods, and improving credit-worthiness.

Skill Development for Youth

- Youth Empowerment: Supports skill development, self-employment, and placement through Rural Self-Employment Institutes (RSETIs), fostering innovation, creating infrastructure, and providing market support.

Financial Support Mechanisms

- Revolving Fund: Provides support to SHGs for enhancing institutional and financial management capacity, building a credit history.

- Community Investment Support Fund (CIF): Facilitates SHGs in intensive blocks with funds for loans and collective socio-economic activities.

Financial Inclusion Model

- Loan Facilitation: Introduces a financial inclusion model, facilitating loans from banks and coordinating with banking/financial institutions. Also, offers coverage for life and health-related risks.

Interest Subvention

- Interest Subvention: Provides interest subvention on SHG loans, covering the difference between bank lending rates and 7%.

Convergence and Planning

- Convergence: Collaborates with various ministries and agencies focused on reducing rural poverty.

- Decentralized Planning: Emphasizes highly decentralized planning, granting states the flexibility to develop their action plans tailored to poverty reduction.

Institutional Linkages

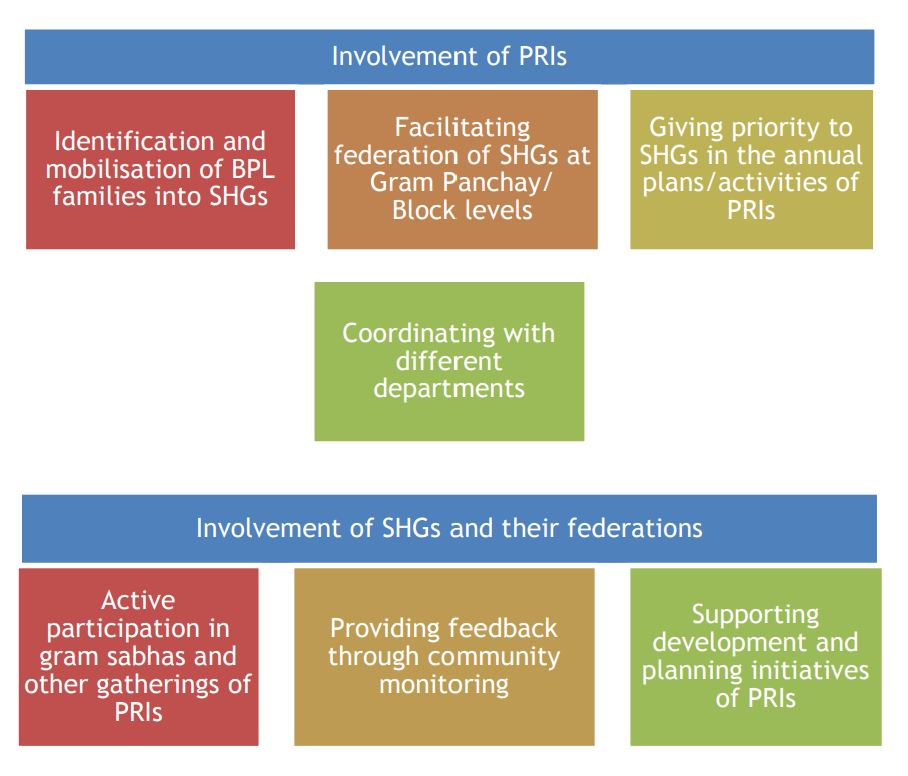

- District-Level Linkages: Establishes suitable linkages with District Rural Development Agencies (DRDAs) and Panchayat Raj Institutions (PRIs) at the district level.

Services and Empowered Beneficiaries

Scheme Focus

The scheme caters to rural poor individuals, aiming to uplift their economic status. Rather than offering direct financial assistance, the scheme takes a holistic approach, emphasizing the organization of the poor into institutions. It focuses on empowering them to take ownership of these institutions, offering substantial capacity building and guidance, facilitating access to institutional credit, and encouraging pursuit of livelihoods aligned with their resources, skills, and preferences.

Empowering through Ownership

- Institutional Formation: The scheme places a significant emphasis on organizing the rural poor into institutions, creating a foundation for collective strength and collaboration.

Building Capacity and Confidence

- Capacity Building: Recognizing the need for empowerment, the scheme provides robust capacity building initiatives. These initiatives are designed to enhance skills, knowledge, and confidence among the beneficiaries.

- Guidance and Handholding: The scheme adopts a supportive approach, offering necessary guidance and handholding support to ensure a smooth transition for the beneficiaries towards owning and managing institutions.

Access to Institutional Credit

- Credit Facilitation: Instead of direct financial support, the scheme promotes access to institutional credit. This encourages financial inclusion and empowers beneficiaries to invest in their chosen livelihoods.

Tailored Livelihood Pursuit

- Resource, Skill, and Preference-Based Livelihoods: The scheme recognizes the diversity among beneficiaries and encourages pursuit of livelihoods that align with their individual resources, skills, and preferences.

F.A.Q.

- Q. What is full form of nrlm?

Answer :- National Rural Livelihood Mission